2022-8-1For tax years beginning after 31 December 2025 the percentage of modified taxable income that is compared against the regular tax liability increases to 125 135 for certain banks and securities dealers and allows all credits to be applied in determining the US corporations regular tax liability. With effect from 1 January 2009 a withholding tax mechanism to collect withholding tax at 10 on other types of income of non-residents under Section 4f of the Income Tax Act 1967 has been introduced.

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Applications received on or after 1 January 2013.

. In Malaysia for at least 182 days in a calendar year. 21 hours agoIncome Tax. Domicile and tax residency are very different things its very difficult for most UK citizens not to be UK domiciled as Lord Denning Master of the Rolls said Domicile is not a raincoat that can be taken off and.

Interest in government securities debentures and. 2022-10-4If you own rental real estate you should be aware of your federal tax responsibilities. 2022-10-21If you bought and sold your property within 12 months your net capital gain is simply added to your taxable income which in turn increases the amount of income tax you pay.

How To File Income Tax As A Foreigner In Malaysia. You do not need to tell HMRC about income youve already paid tax on for example wages. Rental income other than house properties Gifts received.

The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. The capital gains tax in 2011 was 28 on realized capital income. 50000 on home loan interest.

TOP will deduct 1000 from your tax refund and send it to the correct government agency. The gross rental yield is the total rental return on your investment in a property before outgoings. We focus on the premier city where to-buy-let investments are likely to make most sense.

Enterprises operating in the oil and gas industry are subject to CIT rates ranging from 32 to 50 depending on the location and specific project conditions. 2022-3-14All you need to know for filing your personal income tax in Malaysia by April 30 this year. 2022-10-23Tax on Rental Income The tax on rental income depends on the residence the use of the space and other specifics.

Finally only income that has its source in Malaysia is taxable. Spouse under joint assessment 4000. 2 days agoEmployment income - Gross income from employment includes wages salary remuneration leave pay fees commissions bonuses gratuities perquisites or allowances in money or otherwise arising from employment.

For income gained by companies they are taxed by a flat rate of 25 of net income. An individual is regarded as tax resident if he meets any of the following conditions ie. 2021-3-25The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis. 2022-6-13Income tax exemption on rental income from the first year of assessment statutory income is derived until year of assessment 2026 and. Income under Section 4f refers to gains and profits not covered under Sections 4a to 4e of the Income Tax Act 1967.

Below 18 years of age. 2020-2-11In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Be informed and get ahead with.

In Malaysia for a period of less than 182 days during the year but that period is linked to a period of physical presence of 182 or more consecutive days in the following or preceding. The VAT burden is generally shouldered by the tenants. Salaries of the employees of both private and public sector organizations are.

March 14 2022 Share this. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income.

With the profits of selling the investments you have to pay the interest on dividends interest rental or other types of income that you get. 1 day agoHouse Rent Allowance. Even though the interest gained from various tax-saving schemes is tax-free.

2022-2-8Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. The capital gains tax in Finland is 30 on realized capital income and 34 if the realized capital income is over 30000 euros. But you are delinquent on a student loan and have 1000 outstanding.

The VAT is imposed in a flat rate of 10 on the. But if you do not think enough tax has been taken on your employment or workplace pension. Rental income tax for non-residents in Indonesia is imposed in a flat rate of 20 of gross income.

2022-10-23The income tax rate for resident legal persons is 20 payment of 80 units of dividends triggers 20 units of tax due. However if you held onto the property for more than a year before selling it youre eligible for a capital gains discount of 50 which means you only need to. 2022-6-13Reliefs YA 2021 MYR.

2 days agoGet the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. HRA or House Rent allowance also provides for tax exemptions.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. 2022-9-30I suspect many UK origin expats in Thailand who are living of rental income and pensions from the UK are in fact UK tax domiciled. 2020-2-11In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

The government has issued Decree 522021 on extension of deadlines for tax and land rental payments in 2021 which took effect. 2022-7-28The standard corporate income tax CIT rate is 20. 1 day agoIncome Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23.

Properties with rental payments exceeding PHP12800 US272 per month received by landlords whose gross annual rental income exceed PHP1919500 US40840 are subject to 12 VAT. An individual employed in Malaysia is subject to tax on income arising from Malaysia regardless of where the employment contract is signed or. Over 18 years of age who is receiving full-time instruction at an establishment of higher education in Malaysia at diploma level and higher or outside Malaysia at degree level and above or serving under article of indentures in a trade or.

It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund. This exempts income that comes from overseas like rental of property or freelance work and. Gross rental yields vary enormously from one country to another.

Stamp duty exemption of 50 on instrument of transferlease of landbuilding. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when. 1 day agoUnder Section 80EE of Income Tax Act one can claim deduction up to Rs.

Such income under. Instruments executed from 1 January 2013 to 31 December 2023. 2022-6-255 A 12 Value Added Tax VAT is imposed on residential property leases that satisfy certain conditions.

You were going to receive a 1500 federal tax refund.

Property Rental Income Tax In Portugal For Foreign Owner Investors

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

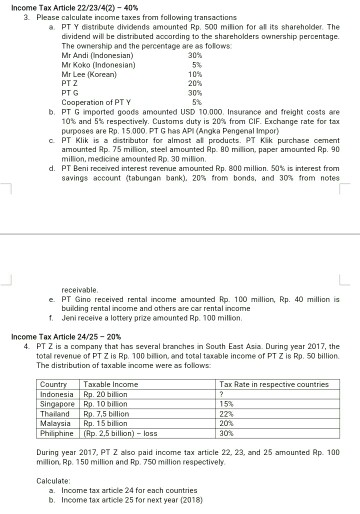

Income Tax Article 22 23 4 2 40 3 Please Calculate Chegg Com

Tax Exemption For Rental Income 2018 Donovan Ho

What Is An Investment Holding Company And When Is It Useful

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

8 Things To Know When Declaring Rental Income To Lhdn

Paying Property Tax In Malaysia Here S Your 2017 2018 Guide Wise Formerly Transferwise

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Airbnb Rental Income Statement Tracker Monthly Annual Etsy

King County Councilmember Dunn Proposes New Plan For Property Tax Relief Auburn Examiner

Property Tax In Malaysia Real Estate Glossary Malaysia Property Property For Sale And Rent In Kuala Lumpur Kuala Lumpur Property Navi

Malaysia Tax Case Rental Income

Solved Investment Incentives Specialised Industries Course Hero

How To Calculate Rental Income Tax For Non Residents Foreigner